Florida's tropical climate makes strong roofing more than a luxury — it's a necessity. But as roofing technology and storm protection standards have evolved, so have Florida's roofing laws. Whether you're a homeowner facing storm damage or a property manager navigating insurance renewals, it's critical to understand how the Florida roof replacement law works today.

Recent legislative changes have shifted the requirements around how and when you must repair or replace your roof — and these updates can significantly impact both your budget and insurance eligibility.

In this post, we'll break down the key changes, explain what they mean for your property, and help you stay compliant while protecting your most important asset.

Understanding the Florida Roof Replacement Law

Florida's original roofing regulation required that if more than 25% of a roof was damaged within a 12-month period, the entire roofing system had to be replaced. This rule often led to costly, full-roof replacements — even when only part of the roof needed attention.

With enactment of Senate Bill 4-D (passed in May 2022) and updates to the 2023 Florida Building Code, the law has changed. . Here's what you need to know:

The New Rule: Partial Repairs Are Allowed

If your roof was constructed or replaced after March 1, 2009, and it complies with the 2007 Florida Building Code or newer, you no longer have to replace the entire system when more than 25% is damaged. Only the affected area needs to be brought up to current code — as long as the rest of the roof is still code-compliant.

Why this matters: This rule change can significantly reduce roofing costs, minimize construction time, and allow you to focus on targeted repairs.

The 15-Year Roof Rule: What Insurers Can (and Can't) Do

Another major shift came with Senate Bill 2D, which introduced protections for homeowners against premature insurance cancellations.

What is the 15-year roof rule in Florida?

Insurance companies cannot deny coverage or refuse to renew your policy solely because your roof is less than 15 years old. If your roof is 15 years or older, insurers must allow you to get an inspection that confirms it has at least five years of useful life remaining before requiring replacement.

This change is critical for property owners across Florida — especially given recent disruptions in the insurance market.

What Are the Roof Requirements to Qualify for Insurance?

Whether you're shopping for new coverage or trying to maintain an existing policy, your roof plays a central role in your insurance eligibility.

Here's what most insurers evaluate:

Roof age - Newer roofs (under 15 years) are rarely an issue

Materials - Metal, tile, and architectural shingles are preferred due to better wind and impact resistance

Condition - Damage, leaks, or worn-out underlayment can result in denied coverage

Shape - Hip roofs often receive better rates than gable designs because they perform better in high winds

Code compliance - Especially important when only partial repairs are being made

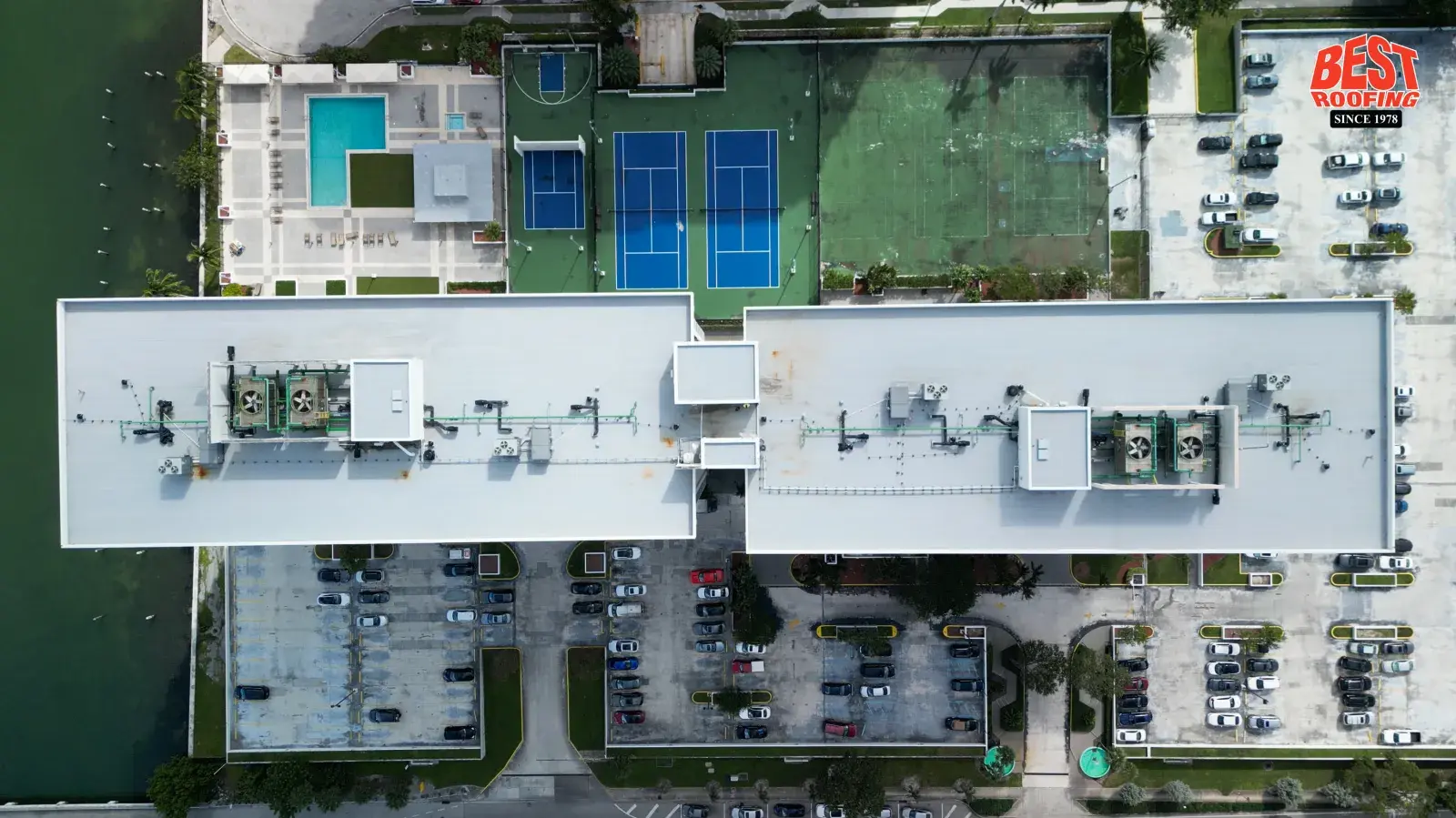

At Best Roofing, we regularly work with property managers, building owners, and homeowners to ensure their roofing system meets both building code and insurance requirements.

What Is the 25% Rule for Roof Replacement in Florida?

Let's recap this frequently asked question with a 2025 update:

Old Rule:

If more than 25% of a roof was repaired or replaced in a 12-month period, the entire roof had to be brought up to current code.

New Rule (Post-2022):

For roofs built or replaced after March 1, 2009:

Only the damaged portion must be brought up to code

The rest of the roof can remain untouched if it complies with 2007 Florida Building Code or newer

This rule applies to both residential and commercial properties and overrides any stricter local municipal codes.

Do I Have to Replace My Roof Every 10 Years in Florida?

No, there is no requirement in Florida law that mandates roof replacement every 10 years.

However, your roof's age and condition do affect insurance decisions and your home's safety. While metal and tile roofs can last 30+ years asphalt shingles typically have a lifespan of 15-30 years depending on installation and maintenance.

Best practice: Have your roof professionally inspected every 2-3 years and after major storms to ensure continued compliance, performance, and eligibility for insurance coverage.

How the Law Affects You During Repairs or Replacements

When planning roofing work, the law now offers more flexibility and potential cost savings — but only if your roof was installed after the March 1, 2009 threshold and remains compliant with the 2007 code or later.

Benefits of the updated law:

Lower cost (partial repairs vs. full replacement)

Faster timelines (repairs can be completed more quickly)

Less disruption for property owners and tenants

Preserves code compliance without forcing full-system overhauls

Always work with a licensed, experienced contractor familiar with Florida's latest roofing legislation. At Best Roofing, we ensure that every project meets the necessary structural and insurance standards.

Tips to Stay Compliant and Protected

Here's how to protect your property and ensure your roof remains compliant with both state laws and insurer expectations:

1. Schedule Regular Roof Inspections

Catch issues before they lead to major damage — especially after hurricanes, heavy rain, or windstorms.

2. Work with Trusted Contractors

Hire roofing professionals who understand Florida's unique codes and evolving insurance guidelines.

3. Keep Documentation

Save inspection reports, repair invoices, permits, and product warranties. These may be required during insurance renewals or claims.

4. Update Aging Roofs Proactively

Don't wait for your insurer to flag an old or damaged roof. If your roof is nearing 15+ years, get an inspection and plan for upgrades.

Florida Roofing Law FAQs

Q: What are the new roof laws in Florida?

A: Florida now allows partial repairs (rather than full replacements) if the rest of the roof meets the 2007 Building Code or later. Insurance providers also can't deny coverage based solely on roof age if under 15 years.

Q: What is the 25% rule?

A: The rule previously required full roof replacement if more than 25% was damaged in a year. For post-2009 roofs meeting newer code, this is no longer required.

Q: Do I need to replace my roof every 10 years?

A: No. While insurers may scrutinize older roofs, there is no legal 10-year requirement. Roof longevity depends on materials, installation, and maintenance.

Need Help Navigating Florida's Roofing Laws?

Best Roofing has proudly served South Florida for 47 years, offering expert guidance on code compliance, insurance requirements, and hurricane-ready roof systems. Our team of licensed professionals is here to help you make informed, cost-effective roofing decisions.

Call us today at (888) 485-9784 or schedule a free inspection.